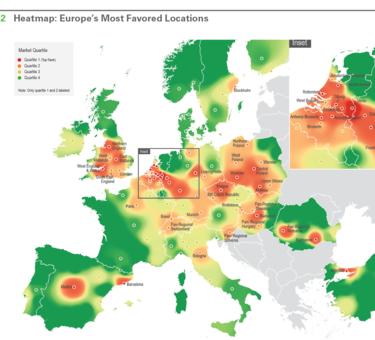

AMSTERDAM (February 15, 2016) – Prologis, Inc., the global leader in industrial real estate, today announced the launch of new research, revealing the top logistics locations in Europe for occupiers.

The top five locations are in the Benelux and praised by occupiers for their good infrastructure and proximity to customers and suppliers.

Venlo, a logistics market in south east Netherlands, near the German border, is Europe’s most desirable location by a significant margin, as it was when the research was carried out for the first time in 2013. Venlo came out top in nine of the 11 location criteria, scoring particularly high for ‘availability of land’, ‘road access, ‘transport cost’ and ‘regulatory’.

| # | 2016 | 2013 |

|---|---|---|

| 1 | Venlo | Venlo |

| 2 | Rotterdam | Antwerp-Brussels |

| 3 | Antwerp-Brussels | Rotterdam |

| 4 | Central Brabant | Rhein-Ruhr |

| 5 | East Brabant | Madrid |

| 6 | Düsseldorf | Liège |

| 7 | Central Poland | Central Germany |

| 8 | Antwerp-Hasselt | Pan Regional Romania |

| 9 | Istanbul | Ile-de-France |

| 10 | Cologne | Düsseldorf |

In second place is Rotterdam, the major port in the west Netherlands, in third the Antwerp-Brussels area in Belgium, followed by Central Brabant and East Brabant in south Netherlands.

Making up the top 10 locations behind the five Benelux powerhouses are the German city of Dusseldorf, Central Poland, Antwerp-Hasselt, Istanbul and Cologne.

In second place is Rotterdam, the major port in the west Netherlands, in third the Antwerp-Brussels area in Belgium, followed by Central Brabant and East Brabant in south Netherlands.

The biggest improvement among locations from the 2013 report is in Central and Eastern Europe (CEE). Central Poland and Istanbul entered the top 10 and Prague is at number 11. In total, eight CEE locations made it into the top 20, compared to four in 2013. Low cost is the major factor for CEE - markets in CEE dominated the rankings in the “cost of labour” and “real estate costs” criteria.

The rise of markets in CEE is at the expense of markets in Western Europe. Markets showing the biggest declines in their ranking are Liege, Paris, Brussels, Madrid and Central Germany. Air cargo hubs, like Frankfurt and Amsterdam-Schiphol, lost ground as well. According to the report, this is due to lower scores for the location drivers “labour availability” and “cost of labour”.

The report, Europe’s Most Desirable Logistics Locations, was carried out by Prologis, in partnership with Eyefortransport, to answer the key location questions facing owners and occupiers of logistics property at a time of huge structural change. The reconfiguration of the European supply chain and the rise of e-commerce means there is significant demand potential for modern, efficient distribution facilities across the region.

A total of 216 occupiers of logistics property from a variety of sectors, ranging from retail to automotive to pharmaceuticals, ranked 100 distribution locations by 11 criteria:

Occupiers favour closeness to economic networks, low costs (both transport and real estate costs) and an availability of skilled labour.